Financial Aid

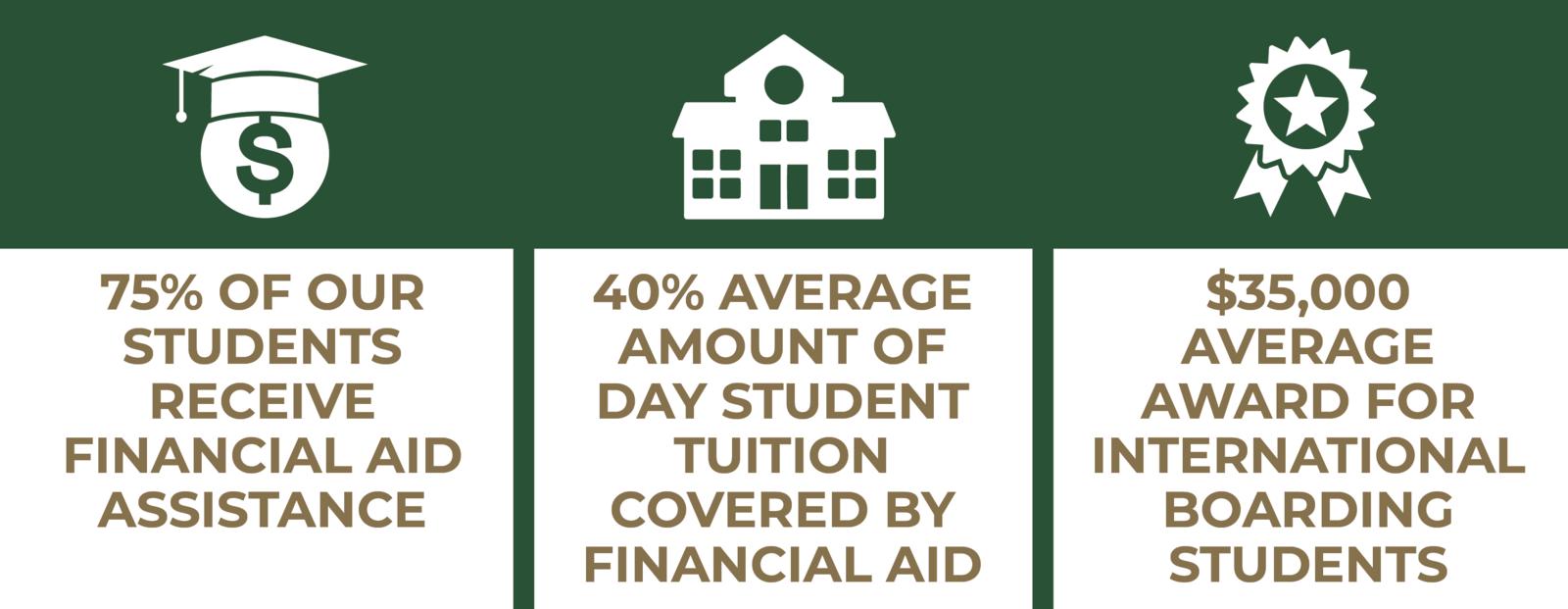

We are committed to making a quality, college-preparatory education financially viable. Annually, Tallulah Falls School awards nearly $5 million in need-based financial aid to over 75 percent of our students. The Financial Aid and Admissions Committees make decisions independently.

The Tallulah Falls School Financial Aid Program is designed to make a TFS education possible for all families based on demonstrated financial need and the availability of funds. Tallulah Falls School is proud to use the Clarity Application to determine a family’s level of financial need based on the information families share in the application, including assets, income, expenses, and debts.

To get started, please go to the Clarity Application and create an account. The application typically takes less than 30 minutes to complete. The Clarity Application is mobile-friendly, so that you can complete it anywhere. You can also save your progress and return it at any time. At the end of the application, there is a $60 fee to submit.

"The financial aid we have received over the years has been nothing short of a blessing. It has allowed our children to thrive in an environment that nurtures them both academically and personally, and we are forever grateful for the support that made this possible.” - Melissa Ball

Please remember to return to your dashboard after you complete and submit your Clarity Application, as Tallulah Falls School requires you to upload additional tax documentation.

Aid applications for returning students are accepted beginning December 1st each year.

If you need help completing your application, in-app support is available through the “Help” button at the bottom left of the screen, and email and phone support is available at support@clarityapp.com or 206-210-3752 in English and Spanish. The application itself is also fully translated into Spanish.

New & Returning Students

All families applying for new student admissions must complete the Clarity Financial Aid Application.

Additionally, international families must upload a letter of employment from each parent's employer(s). (Documents must be in English)

Financial Aid Frequently Asked Questions

All families seeking need-based financial aid will apply annually via the Clarity application. We have chosen Clarity as our application for a financial assistance provider to serve our current and prospective families. We are confident in the simple process of applying for financial aid via Clarity. The application includes uploading tax forms when necessary, linking to the IRS data retrieval tool, and providing other requested documents.

How does Clarity make it easier for families to apply for financial aid?

Clarity offers a streamlined, mobile-friendly application that can be completed in as little as 20 minutes. Additionally, Clarity removes the need to upload your W2 and 1040 by transferring them directly from the IRS. This reduces the amount of information you must manually enter and makes it possible to complete the application quickly and efficiently.

The application will request information on family income, expenses, and assets.

The Financial Aid Committee will utilize the Clarity Financial Aid application and assessment to determine the family’s ability to invest in their student's education at Tallulah Falls School.

Tallulah Falls School offers need-based financial aid and merit aid based on student academic performance.

While Tallulah Falls School cannot meet 100% of a family’s needs, we proudly offer significant assistance to make an independent school education attainable.

As in prior years, if your financial circumstances have not changed, you will not see significant changes to your award. If you have any questions about your circumstances, please contact us.

The Financial Aid Committee understands that events occur outside of the application period that affect a family’s income. These events can be challenging; families with an unexpected loss of income should contact the Financial Aid Office to discuss their situation.

Tallulah Falls School admits students who fit the criteria set by the Admissions Committee and does not use financial need to determine a student's eligibility for admission.

Tallulah Falls School takes the privacy and security of your personal information very seriously. Clarity is certified for GDPR and SOC2 and uses enterprise-level security standards, including end-to-end encryption of all personally identifiable information. For more information, please refer to Clarity’s Privacy Policy.

Yes, Tallulah Falls School offers merit aid based on Academic performance. We do not offer athletic or fine arts scholarships.

- According to the National Association of Independent Schools (NAIS) methodology and principles, parents are responsible for financing their children's education. Both custodial and non-custodial parents (regardless of legal settlements) who are divorced, separated, or never married should contribute to educational costs. In exceptional cases, where one parent cannot comply, the custodial parent should submit the Statement of Explanation Form.

- The conditions under which we may consider waiving the non-custodial requirement are:

- The non-custodial parent's whereabouts are unknown.

- The non-custodial parent has not had contact with the applicant for an extended period.

- The non-custodial parent provides no financial support to the student.

- The conditions under which we may consider waiving the non-custodial requirement are:

- At Tallulah Falls School, we are committed to providing an inclusive and diverse educational environment for all students. We understand that families go through various life circumstances, including divorce. To support divorced parents who wish to provide their children with quality education, we have developed the following policy specifically designed to address the needs of divorced families.

- Definition of Divorced Parents

- Divorced parents refer to legally separated or divorced parents with joint or sole custody of their child.

- Financial Aid Eligibility

- Divorced parents are eligible to apply for financial aid following the standard financial aid application process.

- Non-Custodial Parent's Financial Information

- It would be unfair for the school to subsidize a student's education when one parent is capable but unwilling to contribute to the student's education expenses. Instead of both parents submitting the required documents, the school may consider an amount equal to three-quarters of the student's child support.

- A divorce agreement does not negate a parent's responsibility for educational expenses. The application should reflect each household's income.

- If a student has a guardian who is not their parent, the school requires letters of guardianship.

- It would be unfair for the school to subsidize a student's education when one parent is capable but unwilling to contribute to the student's education expenses. Instead of both parents submitting the required documents, the school may consider an amount equal to three-quarters of the student's child support.

- Definition of Divorced Parents

A number of factors determine whether or not a family qualifies for financial aid, including assets, income, and expenses. Tallulah Falls School is proud to assist many families with different socioeconomic circumstances and encourages all to apply for assistance.

Returning families must submit their full, completed application by February 1st each year. Newly accepted families' applications must be submitted two weeks after they are accepted into the school.

Yes, all families must complete the Clarity application to the best of their ability, including the Non-US Tax Filer Verification upload. If you live in Canada, you will be prompted to upload your T1, T4, and Notice of Assessment.

Please click to review the Tallulah Falls Financial Aid Policy.